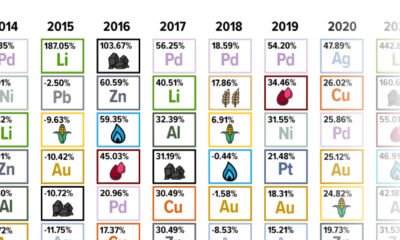

The Periodic Table of Commodity Returns (2014-2023)

It was a challenging year for commodity returns in 2023.

But there were a few exceptions. Gold was a standout performer, reaching record highs of $2,135 an ounce. As rate cuts began to look more likely in 2024, investors sought out the safe-haven asset and a weaker dollar also boosted demand for gold.

Copper, meanwhile, barely etched its way into the green, as China’s slumping property market weighed on demand.

This graphic, based on U.S. Global Investors interactive research, shows commodity returns over the last decade.

Commodity Returns in 2023

After several years of strong performance, most commodities ended 2023 in negative territory, as the table below shows:

| Commodity | 2023 Return |

|---|---|

| Gold | 13.10% |

| Copper | 1.19% |

| Aluminium | -0.17% |

| Silver | -0.66% |

| Platinum | -7.67% |

| Coal | -9.97% |

| Crude Oil | -10.73% |

| Zinc | -12.10% |

| Palladium | -12.93% |

| Wheat | -20.71% |

| Corn | -30.55% |

| Lead | -38.63% |

| Natural Gas | -43.82% |

| Nickel | -45.21% |

| Lithium | -81.43% |

In a departure from other commodities, gold jumped over 13%, driven by investor demand and central bank purchases.

Over the first three quarters of 2023, global central banks bought roughly 800 tonnes of gold, with China, Poland, and Singapore being the top buyers.

Crude oil sank nearly 11%. In 2023, the U.S. produced a record 13.3 million barrels per day in mid-December, supported by growing operational efficiencies. The number of active U.S. oil rigs stands at 501—a 69% decline from a decade ago.

Also putting pressure on oil prices was slower global demand as interest rates notched higher.

Like crude oil, the supply of lithium and nickel were robust last year, causing prices to fall sharply. In fact, some major producers reined in production amid collapsing prices last year. The surplus in lithium supply is projected to reach 30,000 metric tons globally in 2024, outpacing demand.

Outlook for 2024

While slower global growth could dampen commodities demand in 2024, the easing of interest rates by the Federal Reserve could be beneficial.

ING projects that gold will hit new highs in 2024, with potential rate cuts supporting prices.

From a geopolitical standpoint, escalating tensions in the Middle East could lead to stricter U.S. sanctions of oil in Iran and tighter supplies. OPEC+ policy, which has pushed for supply cuts, could also influence oil prices.

Commodities used in the green energy transition—such as nickel, copper, lithium, and zinc—have mostly bearish outlooks. A significant supply glut in nickel could depress prices, with a forecasted 239,000 metric ton surplus in 2024.

Copper, lithium, and zinc are also forecast to have surpluses next year.

However, taking a longer-term view, the IEA projects that copper production from existing mines and those in construction will meet 80% of climate goal requirements by 2030. For lithium, it will meet just half of these requirements in the green energy transition.