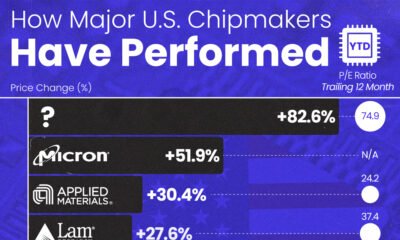

The Stock Performance of U.S. Chipmakers So Far in 2024

Is there anything more wanted than a chip stock right now? Four of the biggest U.S. chipmakers have accounted for a staggering one-third of the S&P 500 gains in 2024 so far.

But what does that look like for the individual companies?

We visualize the year-to-date (YTD) stock performance of major American chipmakers, ranked by market cap. Price-earnings ratios (trailing 12 months) were included for additional context. Data is sourced from TradingView, current up to April 3rd, 2024.

America’s Biggest Chip Stocks See Strong Growth 2024

The Nvidia rocket ship is refusing to slow down; the stock is up almost 80% YTD in 2024. This is after its more than threefold rise last year, joining the trillion dollar club in May 2023.

However, Nvidia’s isn’t the only one amongst the big U.S. chipmakers to have a strong Q1 stock performance. Micron Technology (memory chips) and Applied Materials (manufacturing equipment) also posted big gains on Wall Street.

| Company | Price Change (Since Jan 1, 2024) | P/E Ratio (Trailing 12 Month) |

|---|---|---|

| Nvidia | 82.6% | 74.9 |

| Micron Technology | 51.9% | N/A |

| Applied Materials | 30.4% | 24.2 |

| Lam Research | 27.6% | 37.4 |

| AMD | 25.9% | 341.5 |

| Broadcom | 25.6% | 49.6 |

| KLA | 22.3% | 35.2 |

| Qualcomm | 22% | 24.79 |

| Texas Instruments | 0.7% | 24.1 |

| Analog Devices | -1% | 34.9 |

| Intel | -17.4% | 113.9 |

| S&P 500 | 9.8% | N/A |

Many of these firms have benefited from the ongoing AI craze, as well the U.S. government’s efforts to ramp-up domestic chipmaking capacity.

The one big outlier to this is Intel, who has been having a rough couple of years. Its foundry business—which makes chips for competitors—has been losing money, scaring off investors from a stock with an already fairly high P/E ratio.

What Does the P/E Ratio Tell Us?

The price-earnings ratio is the proportion of a company’s stock price to its earnings per share (EPS).

We’ve visualized the trailing 12 month (TTM) P/E ratio, which divides current stock price by EPS over the past 12 months. The one downside to this metric is some fundamental stock market wisdom—past performance doesn’t determine future earnings.

In terms of P/E ratios, AMD and Intel are the two outliers at 341.5 and 113.9 respectively. In AMD’s case, this means that investors are willing to pay $341.5 per $1 of earnings.

This is substantially higher than all of the other companies on this list, suggesting that investors expect AMD to grow a lot in the future.